From Average to World Class – Assessing Finance

The Journey towards World Class

This is our fourth and last article of the four-part series. So far, we have discussed the birth of Next Generation Finance, the Roadmap to implement an analytics culture, and the Mindset aspirations to decision making. In this article, we conclude by taking the temperature on where Finance is on its journey towards becoming world class.

Next Generation Finance should act as a predictive analytics powerhouse that influence and impact business decisions. But, too often, Finance hasn’t updated its skillset and systems toolbox with the most emerging technologies. As such, Finance still operates largely as a spreadsheet-driven rear-facing accounting and reporting center.

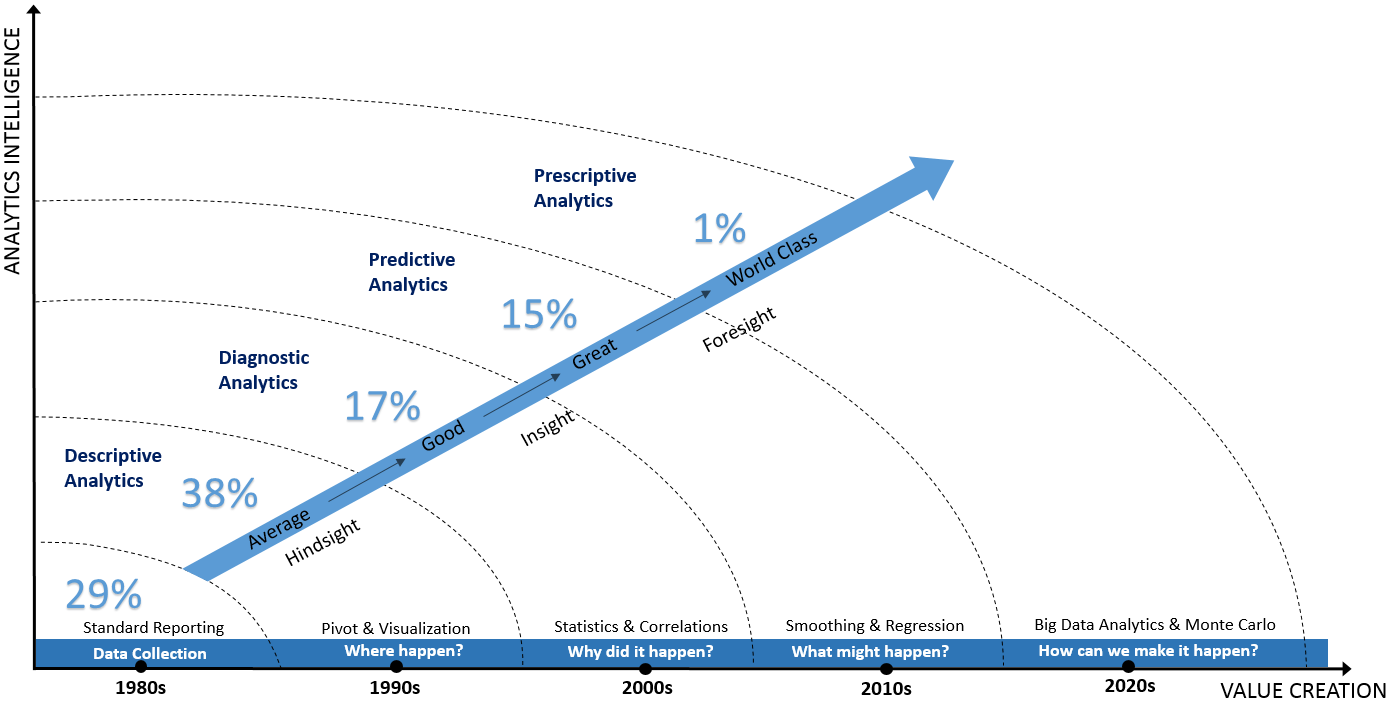

Our research, shown on the chart below, indicates that Finance organizations surveyed, spends some two thirds of its time in data collection (29%) and gathering data and compiling reports on historical performance (38%). This leaves precious little time to provide high-value add analytical insight and foresight.

The chart further illustrates how the Finance function, on average, is 20-30 years behind the evolution of analytics, as only 1% have aligned their capabilities to emergent technologies like Big Data Analytics using artificial intelligence and Monte Carlo to simulation.

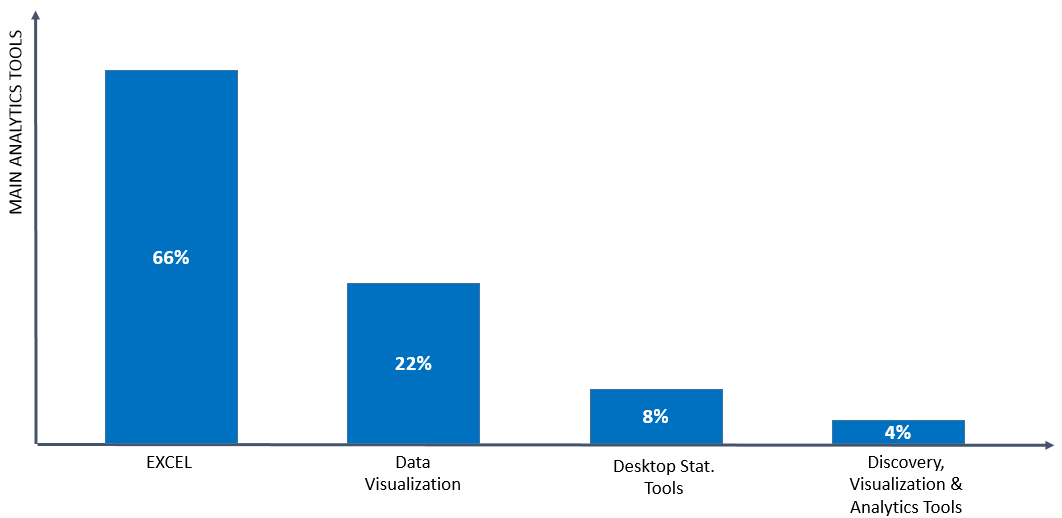

This is backed up by the chart below that show that the main analytics tool for Finance is still Excel. Only some 12% of Finance groups surveyed have access to high value-add analytics tools like Desktop Statistical or Discovery, Visualization & Analytics tools. This is staggering, as in the 21st Century, the Finance predominant tool for reporting, visualization, and analytics in 20th Century technology!

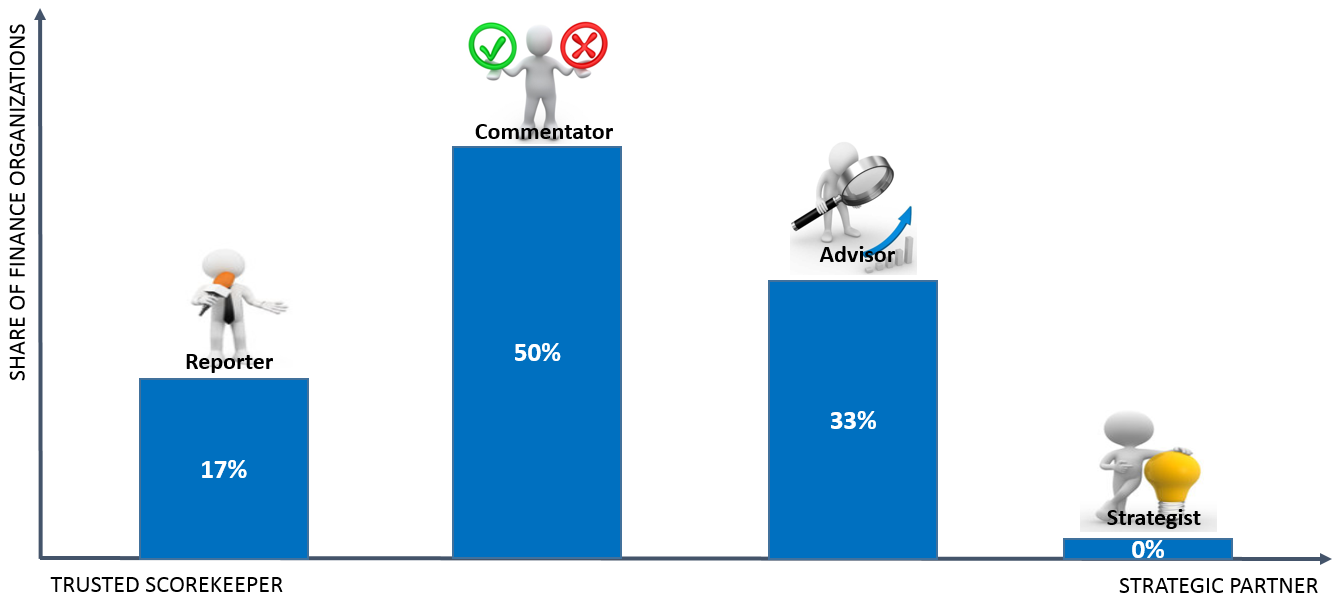

Further our study reflected on the chart below, shows that less than 1% of Finance organizations see itself as Strategists who predict events and simulate risks and opportunities. 33% self-classify as Advisors where they use statistics to influence decisions. While 50% are Commentators focused on hindsight reporting and variance analysis. The remaining 17% of Finance organizations consider themselves Reporters focused on data capturing and delivering timely and accurate standard hindsight information.

There is quite a way to go for Finance to become the world class strategic partners, but Finance has the interest and intent to move beyond the trusted scorekeeper towards the strategic business partner. Our research shows that 67% aim to become Strategists in the future, 22% Advisors, 17% Commentator but, most important, no one wants to remain Reporters!

+ There are no comments

Add yours